Rousseau Institute report CO2-neutral Europe: meat taxes needed

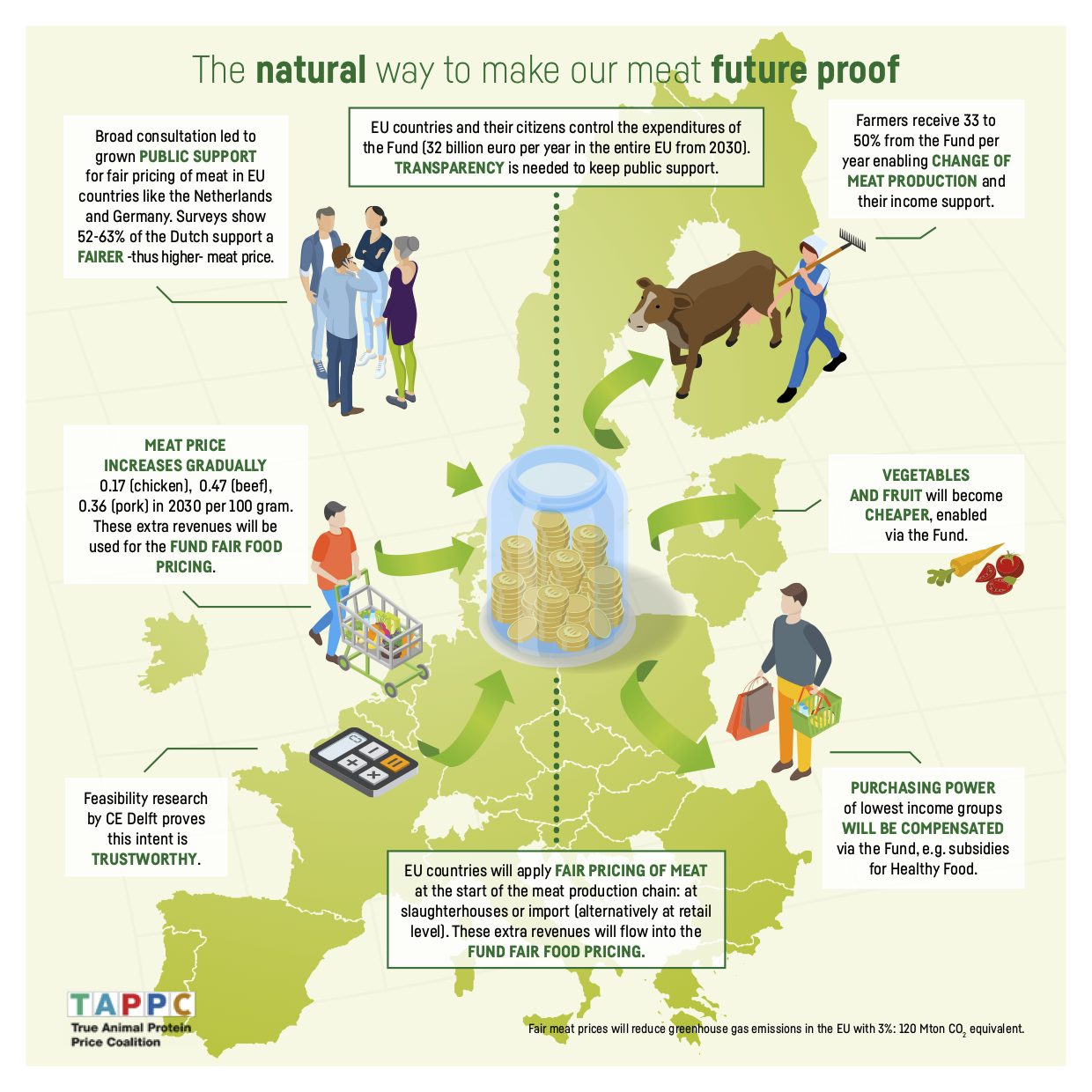

The TAPP Coalition is happy to support the "Road to Net Z€ro" report recently published by the French Institut Rousseau, written by many scientists with support of many European research institutes and organisations. In the Annex report it is explained in detail how a tax on meat looks like.

This project aims to quantify the public and private investments needed to decarbonize the European economy by 2050 to net zero. For a socially just transition in the agriculture, the Institute wrote that a tax on meat - inspired by TAPP Coalition - is very urgent. Tax revenues have to be used to compensate farmers to reduce their herd size (40%), subsidize consumers to make organic food (and other sustainable food) cheaper for consumers (50%) and support developing countries for their climate policies (10%) according to the institute. In 2021 TAPP Coalition published two similar proposals for EU wide taxes on meat, recycling tax revenues towards farmers and consumers too. In 2023 TAPP Coalition published another report on EU wide taxes on meat, dairy and eggs, recycling tax revenues to consumers only for healthy food vouchers. The Rousseau Institute combined the policy proposals from the three TAPP Coalition reports. The meat tax level in the Rousseau report is lower compared to the taxes proposed by TAPP Coalition. The Rousseau report proposes a tax of 1.5 €/ kg in 2050 for beef and 4.5 €/ kg for pork and poultry meat. The TAPP Coalition proposed a tax of 2.04 €/kg for chicken, 4.50 €/kg for pork and 5.70 €/kg for beef and veal in 2030 in the 2021 report and a tax of 10.15-2.24 €/kg for beef, 1.91 €/kg for pork and 1.44 €/kg for chicken in the 2023 report. The reason for the lower tax for beef in the Rousseau report is based on a study published in Nature Food.

In box 5.4 the Rousseau Institute explains why they did not prioritise a more significant reduction in beef production. Their model of TYFA-GHG "recommends a more substantial reduction in the production of climate-efficient animals like swine or poultry, while advocating for a comparatively lesser reduction in bovine production. This strategic choice is based on the understanding that, despite ruminants and the maintenance of permanent grasslands posing challenges for climate mitigation, they play vital roles in fertility transfer at the territorial level and make substantial and irreplaceable contributions to biodiversity and the conservation of natural resources. By consuming resources that are not edible for humans, they also contribute to the overall food balance in a rather efficient

way".

The Rousseau Institute has quantified the necessary additional investment at 2,3% of EU-27 GDP for GHG emission reductions in 2050 for all economic secotors: €360 billion per year is needed to reach 519 million tons of CO2-eq per year by 2050 (-85% reduction, compensated by carbon sinks for net neutrality). Seven major countries are studied in detail: France, Germany, Italy, Spain, the Netherlands, Poland and Sweden. These countries represent approximately 77% of EU-27 GDP and 73% of domestic emissions.

Now the EU Commission will present its 2040 climate targets 6th February, and farmers are protesting everywhere in Europe, let's see what is advised in the report for agriculture?

To cover 100% costs for zero-emission tractors, 3,3 billion euro/year is needed additionally. Financial support to feed additives reducing methane emissions costs addtionally €0.18 billion per year.

Most of GHG emissions can be reduced by 100% organic/agro-ecologic agriculture by 2050. Double the average aid per hectare for organic farming and extend it to agro-ecological practices is needed. Public extra cost: €18 billion per year.

Making organic food and other sustainble food accessible by agro-ecological/quality food checks (vouchers). Public extra-costs are €12,7 billion per year financed by a tax on intensive meat.

Public extra-cost of €9,6 billion/yr for financial assistance to farmers for expansion of extensive farming practices and compensating for reductions in herd size. This is financed by a tax on intensive meat generating 24,8 billion euro/year on average.

Livestock accounted for 54% of EU agri-emissions in 2021. To cut these emissions, herd sizes must be decreased and meat consumption reduced. This can be done through a progressive tax on intensive meat. The tax revenue should be redistributed to compensate breeders and support efforts to make quality food affordable for all. To accelerate the business-as-usual 0.6% annual decline in meat consumption since 1990, a progressive tax on intensive meat is recommended. The tax design, inspired by the True Animal Protein Price Coalition, has been adapted to fit to TYFA-GHG projections by type of animal. It starts at 10 cents per kg for beef and 20 ct€/kg for pork and poultry in the first year, rising to 35 cents/1.2 €/kg by 2030 and up to 1.5/4.5 €/ kg in 2050. With an estimated average tax cost of €1.8 per kilogram from 2022-2050, it would generate a €669 billion revenue on the total 2023-2050 period (i.e. a €24.8 billion annual average).

The tax on intensive meat seeks not to raise meat prices overall but specifically those from factory farms. This aims to curb their consumption. Revenues of this tax would be redistributed as follows:

• 40% to compensate breeders compelled to reduce their livestock due to the overall decline in meat consumption, especially for granivores

• 50% to support affordable quality food, through agro-ecological food checks (or social food protection)

• 10% to support developing countries in reducing their GHG emissions and adapt to climate change.

In the Rousseau Annex report more details about the tax design and the reduction of livestock numbers can be found:

• Emission reductions follow the TYFA GES scenario, encompassing feed supplements.

• Livestock numbers: In transition, the EU-scale livestock population evolves according to the TYFA GES scenario (+14% for cattle due to increased emphasis on cattle farming, -30% for sheep, -48% for pigs, -62% for poultry).

• At the national level, the breakdown follows the current distribution of cattle among countries (source: Agridata 2019).

Intensive Meat Tax: implemented from 2024, this tax exclusively targets intensive meats to avoid hindering the challenging conversion of various livestock types to agroecology. The tax aims not to stigmatise current extensive farmers, often at the forefront of ecological transition and poorly compensated.

• Share of meat production to be taxed: starting from current ‘extensive/intensive’ ratios (i.e., extensive or agroecological vs. conventional intensive) of 10% for pork, 10% for chicken, and 20% for beef. A linear progression of this ratio is assumed to reach 100% extensive for all animals by 2050, with a 2040 milestone of 50% for pork and chicken and 60% for beef.

• Tax Amount: a gradual and linear increase from nearly zero in 2024 to the following by 2050: +4.5 €/kg for chicken, +4.7 €/kg for pork, +1.4 €/kg for beef. The 2050 amounts are based on the proposals of the True Animal Protein Price Coalition (TAPCC) but adjusted proportionally to the livestock changes projected by TYFA GES (in contrast to TAPCC, which primarily targets beef).

• Tax Redistribution: based on TAPCC's suggestions, we propose redistributing the tax amounts (approx. €700 billion by 2050) as follows:

• 40% to farmers, either as support for conversion or compensation for herd size reductions.

• 50% to consumers, in the form of checks or ‘agro-ecological food’ social protection, with

the amount indexed to household income for universal access to quality food.

• 10% for aid to developing countries (mitigation and adaptation).

This redistribution aims to make agro-ecological products more accessible, promoting changes in production systems through demand, in addition to conversion and employment aid. To prevent a rebound effect on imports of environmentally inferior meat, we also propose a border tax and/or safeguard clauses (going beyond GHG considerations).