Dutch Minister of Agriculture and Dutch parliament want food taxes to finance sustainable agriculture

The Dutch Minister of Agriculture, Nature and Food Quality Carola Schouten is working on a levy on food to finance a future earnings model for sustainable agriculture. This as a result of the Bisschop motion (10 December) and earlier announcements by Agriculture Minister Schouten to the Parliament at the end of September that she is working towards a tax on meat, including external environmental costs, whereby the tax proceeds can be used to finance sustainable and animal-friendly farming (see appendix about the Dutch 'true meat price' proposal sent to Dutch Parliament 22nd of April 2020). The German Agriculture minister Julia Klockner announced her plans for a meat tax (Tierwohl Abgabe) on March 2, 2021.

The commitment of Minister Schouten was evident from a letter of 9 March 2021 with an answer to questions from the House of Representatives on 18 January 2021 under number 21 501-32 by the liberal parties VVD and D66, christian democrats CDA, and GroenLinks and PvdD about the annotated agenda of the Agriculture and Fisheries Council of 22 February 2021. See:

Carola Schouten wrote: "At the same time, I am looking for ways to express the external costs of consumption and production in the market price. The aim of 'environmental pricing' is to stimulate consumers, chain parties and producers to look more actively for opportunities to reduce external social costs. This can be done in various ways, such as by providing clear and unambiguous information about the 'real price' of food (information about sustainability to create awareness), and / or by actually charging these costs and benefits. In the event of a tax on relatively polluting food products, a point of attention is whether or not supermarkets pass on the higher price to customers. If not everyone does this, and supermarkets compete with each other, it will lead to chaos and ineffectiveness, because consumers are also and in some groups mainly guided by price. The result: what is cheaper elsewhere, is attracting demand. "

Jeroom Remmers, director TAPP Coalition replies: "According to economists and CPB (Dutch economic governmental institute) VAT tariff increases normally are transferred for 75% towards consumers, so a tax on meat at supemarket level will probably also be included in the consumer prices for at least 75% of the tax tariff. If tax renenues will be used to pay and compensate farmers for efforts to improve sustainability and animal welfare standards, net income at farm level will increase as a result of the meat tax and the refund system".

Almost all political parties want a tax on food to finance sustainable agriculture - SGP motion

On December 10, 2020, all political parties in the Dutch Parliament (except PvdD and group Arissen) voted in favor of the motion by Member Bisschop (SGP) 35600 no. 43 on 'a long-term future perspective for the agricultural sector',. This text mentioned: 'the introduction of taxes on products of which the proceeds are used for sustainability'.

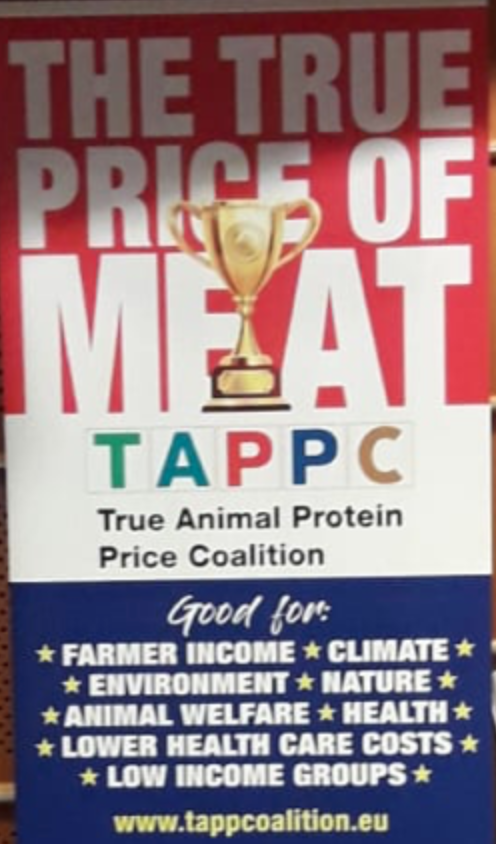

This can be seen as a success for the proposals of the TAPP Coalition, which has been advocating this type of levies on products such as meat and dairy since the end of 2019, where the proceeds are used to financially support farmers if they take or have taken extra-statutory measures in the field of the environment, climate, nature or animal welfare. See the report 'Samen op weg naar eerlijke beprijzing' and 'Aligning food prices with the EU green deal' with an elaborated proposal for almost 30 specific payment schemes for farmers, that would become possible if there were to be a higher meat price (consumption tax on an environmental basis). In Germany the government also wants to introduce such a meat tax. At the beginning of March 2021, the German government (Julia Klockner) published a proposal for a VAT increase on meat and dairy from 7 to 19 percent, which should generate a lot of money every year so that farmers can invest in animal welfare, the environment and nature. The main German agricultural organization wants the proposals to be implemented quickly and completely. In the Netherlands, various agricultural organizations support the proposals of the Tapp Coalition (including 1000 dairy farmers in the GRONDig network) and a few hundred farmers from Caring Farmers).

MOTION SGP member Bisschop 35600, nr 43

Proposed December 10, 2020 The Chamber, after hearing the deliberation,

is of the opinion that for an economically and ecologically sustainable and long-term future perspective, as also expressed in the circular agriculture vision memorandum, it is important for the agricultural sector, as in the Foodvalley, with sector and chain parties, banks, relevant social organizations and regional authorities to make agreements about, among other things:

- the interpretation and financing of source measures in the nitrogen reduction and nature improvement program;

- development and recognition of emission abatement techniques and management methods, and the necessary room for experimentation for this;

- company-specific monitoring and settlement of emissions and the introduction of an accountable substance balance;

- a business model for emission-limiting and other sustainability measures;

- the marketing of new concepts;

- introduction of levies on products of which the proceeds are used for sustainability;

- the use of blue-green services;

- long-term investment opportunities for farmers for future-oriented business operations;

An overwhelming majority of Dutch Parliament supported a proposal for taxing food products:

Including a proposal of ‘real or true pricing of meat’: an excise duty per kg meat (including environmental costs)

Broad Societal Reconsiderations (BRS)

Report 10 ‘Best before, moving towards a sustainable food system’

Translated from Dutch “Brede Maatschappelijke Heroverwegingen” (BMH)

https://www.tweedekamer.nl/kamerstukken/brieven_regering/detail?id=2020Z07213&did=2020D15415https://www.rijksfinancien.nl/brede-maatschappelijke-heroverwegingen

Introduction

This policy proposal has been addressed to the Dutch Parliament to identify effective policy options and reforms in preparation for the next Dutch government (2021-2024), when a downturn is expected. Political parties have included policy proposals from the BRS in their election programs. The BRS reports are written by high officials from all Ministries, supported by scientists and government institutes.

Sixteen social challenges have been identified across the full spectrum of the collective sector. The options cover investments and intensifications as well as (fiscal) reforms and savings. They are based on conversations and meetings with policymakers, scientists, institutions and practitioners. In this document, we focus on the recommendations for the Ministry of Agriculture on food prices.

A meat tax proposal was one of the policy proposals calculated and proposed. Revenues are proposed to be used to pay farmers to improve sustainability standards and improve income, but also to reduce consumer prices for healthy food products like vegetables and fruit. Impacts on reduction of GHG emissions and health care costs were very positive.

The proposal for a meat tax was adopted by 8 political parties for the 2021 elections in the Netherlands, including Christian Union (party of Dutch Agriculture Minister Schouten) and liberal party D66, part of the Dutch government too. Also the Green party and Party for the Animals supported the tax proposal. This increased chances that a next Dutch government will decide to introduce a meat tax in 2023/2024.

Table: Dutch meat tax proposal for 2023-2030 in feasibility study sent to Dutch parliament, to include costs for GHG emissions, nitrogen, particulate matter and biodiversity loss (differentiated tax levels)

Summary

Our food system is not sustainable in its current form. The effects on the environment, climate and health(care) are not included in the price of our food. The social costs of our food are higher than what we pay in the supermarket.

In recent decades, agricultural policy has primarily been focused on economic efficiency of production. The current cabinet is committed to sustainability and prevention of obesity and other diseases. However, incentives for more sustainable and healthy food production and consumption have been fragmented and are insufficient.

Farmers, supermarkets and consumers will have to fulfill a new role in the food system in a more sustainable way. The working group identified several success factors for this transition from farm to fork:

- Clarity about what a sustainable food system entails, and the meaning for all actors in the system.

- Integrated system approach: current policy is aimed at producers (agricultural policy) and on the other hand consumers (health policy). Synergies should be created through policy and implementation. The responsibility for making the system more sustainable is shared by all actors.

- Consistent and unambiguous policy that supports sustainability: food policy has in recent decades been strongly focused on the economic efficiency of primary production. Objectives for nature, climate and health were also added. But all this has happened without fundamental change to the food system.

- Combinations of types of government interventions, including pricing and standardisation: the current consumption policy is strongly focused on informing and stimulating. For production, there is a complex system of regulations. Sustainability requires a more balanced policy mix and interventions. Besides informing and stimulating, now also pricing and standardization are needed.

- Regional customization and coordination.

- Space to respond to opportunities and uncertainties.

- Promote support (including consumers, producers and chain parties).

Recommendations

Taking the above into account, the BRS working group presents a wide range of policy measures for making the food system more sustainable.

- A basic package with preconditions and policy measures including the introduction of positive price incentives for sustainable food and negative price incentives for unsustainable food. The pricing can take different forms, through a special consumption tax, subsidies or revision of the VAT rates.

- Options for redirecting non-sustainability measures.

- Additional variant in which the government facilitates the transition by setting frameworks.

- Additional variant in which the government facilitates the transition by prescribing working methods.

- Optional incentives.

Price signals regarding sustainable and healthy food to consumers (translation)

Price signals are issued to promote the consumption of sustainable and healthy food. The working group offered options, such as the introduction of a consumption tax or adjustment of the VAT rates. The effectiveness and the consequences for the implementation and enforcement of the measures must of course be weighed.

The price signals are primarily for meat, vegetables and fruit and sugars (in soft drinks and juices). Revenues from pricing measures, such as levies on meat and sugar, can be used to further promote and support making the food system more sustainable and healthy. This so-called 'backflush' of resources can be done in various ways, e.g. via a backflush to consumers - especially in lower income groups - and incentives for sustainable (food) production and consumption such as fruit and vegetables.

Budgetary impact (translation)

The policy options presented are expected to decrease the societal costs over time. In addition to this margin, the tax measures on meat and sugar will generate tax revenues from 2023 onwards. It is recommended to use parts of this revenue to lower the price of fruit and vegetables. In addition, revenues can be used to (partly) reduce negative welfare effects for consumers and for additional sustainability investments of producers/farmers. The pricing / tax measures require technical and administrative adjustments from private companies. The potential effects legitimize such a process.

Effects levy on meat by external effect per kilo, a levy on the price of soft drinks of 30% per liter and a price reduction of fruit and vegetables via a lower VAT.

see Table 4.2, page 35

Conclusion about the BRS recommendations to Dutch Parliament (written by TAPP Coalition)

As a result of the policy proposals of a higher price of meat and lower prices for vegetables and fruit, Dutch consumers will eat healthier, which will keep or improve their health. As a result, the rising healthcare costs will rise less (reduce). Because less meat and more vegetables will be eaten, according to the BRS report and the PBL institute who made the calculations, the number of new diabetes patients will decrease by 7.6% from 2025 (4434 persons). The decrease is 2.7% (2883 people) in stroke and 2.9% (454 people) in colon cancer. Health care costs will reduce with 57 million euro per year as a result of the policy proposals. This proposal will also reduce CO2 emissions (2 Mton CO2 eq per year). 18 million cubic meters of water is saved and more land can be used for other purposes compared to animal feed production.

The Dutch government has listened to scientists and others asking for fiscal and subsidy reforms to make sustainable and healthy food the easiest choice for consumers and to make food with negative impacts on health and the planet more expensive. The TAPP Coalition proved in 2019 that a majority of 63% Dutch consumers support a higher price (tax) on meat, if revenues are used to make the price of vegetables and fruits cheaper and compensate farmers and low income groups. The authors of the BRS report did include this strategy into their policy proposals.

Attachment 1 Real pricing of meat (translation of BRS text)

Consumption tax by external effect

Target: Reduction of negative effects on health and the environment as a result of meat consumption

Substantiation and intended effect of the measure

The Health Council makes a link between the consumption of red and processed meat and certain diet-related diseases, namely: stroke, diabetes, colon cancer and lung cancer. The Health Council recommends in its "Guidelines for Good Nutrition 2015" to limit the consumption of red and, in particular, processed meat.

At the same time, the production of meat has negative effects on the environment that have not (sufficiently) been passed on in the current price paid by the consumer in the supermarket or at the butcher's shop. The result of this "unrealistic" low price is "too great" demand and too large a production of meat and meat products. Meat is by far the largest part of the 'footprint' of Dutch food consumption. This contributes to the current consumption footprint, which is measured in a country footprint and a greenhouse gas footprint, does not fall within the limits of a sustainable food system.

The measure sends out a signal through higher prices about a more realistic price for meat and about the undesirability of too high a meat consumption. The higher price means that meat consumption will decrease. Due to the reduced demand, the production volume and emissions from meat production are also decreasing.

Instrument design

Option 1: High 21% VAT rate will apply to meat

Option 2: Special consumption tax according to external effect per kilo of meat (excise duty)

The rate concerns both meat produced and imported in the Netherlands. This prevents a substitute stream of meat produced abroad from destroying the health and environmental impact. This also prevents the competitive position of Dutch producers from deteriorating.

The tax on all finished meat products goes uniformly to the high VAT rate of 21%. No distinction is made between different types of meat with different impacts on health and the environment. The instrument is designed as a special consumption tax per kilo of meat. This is in addition to the usual VAT. The rate is geared to the "external" (not yet priced) environmental effects per kilo of meat and is therefore differentiated automatically. Beef, pork and chicken have varying effects on the environment (disease burden due to meat consumption is not included in this rate). The calculation is based on the maximum rate in 2030 (see below). This rate could be introduced gradually, increasing further over time. The rate must be such that an effective behavioral effect can be achieved (see effectiveness).

Table: Dutch meat tax proposal for 2023-2030 in feasibility study sent to Dutch parliament, to include costs for GHG emissions, nitrogen, particulate matter and biodiversity loss (differentiated tax levels)

Indication of effect on indicators

The figures presented here are based on simplified model calculations, for the method, its limitations and the sources and assumptions used, see appendices 8 and 9. These figures indicate the magnitude of the effect. The assumptions made can have a major effect on the results of the calculations. The figures can therefore only be used to compare the magnitude of the effects of the various price interventions in this report.

The pricing of the external effect involves a decrease in the number of new patients by 1.5 - 7.5% and a decrease of 6344 DALYs. The expected environmental gain from pricing the external effect is considerably greater than in the 21% VAT scenario. This is because all tax rates are higher and because a higher rate for beef and pork is added to the price because of the higher environmental impact than for chicken, which will cause a more significant decrease in consumption and production and thus the environmental damage than in the case of a lower uniform 21 % rate. The same goes for the health gain, which is entirely with red meat (beef and pork). At a higher price for beef and pork, health damage will therefore also decrease through lower consumption. The drop in the number of new patients estimated here is of the same magnitude as previously found in a social cost-benefit analysis of price interventions on meat (Biesbroek 2019). The consumption of meat, especially beef, contributes significantly to the burden of disease due to food-borne infections such as salmonella (Pijnacker et al 2019). With a decrease in meat consumption, the burden of disease due to food-borne infections will also decrease (but not directly.

At the same time, in the CBA meat (Biesbroek) there is a higher welfare gain than the indication given above. For example, no effect on productivity has been included here. In the CBA, as a result of a comparable order size tax on meat, this profit is estimated at a minimum of 604 million euros over a period of 30 years. Health costs and disease burden of food infections from meat consumption in euros are not included. An estimate of this amounts to a reduction of approximately € 13 million in health care costs and € 17 million in reduced DALYs per year if such a target tax on meat would be introduced.

Assessment criteria

Effectiveness

The measure is effective in influencing consumer behavior in the desired sense. The World Bank (2020, Obesity) indicates that the most effective measure is pricing for impact on unhealthy eating behavior.

The level of the rate is a point of attention for the design. To be effective, the World Bank indicated that the rate should be high enough to bring about a change. In this regard, the World Bank quotes the WHO as indicating that a rate increase should be at least 20% of the retail price. This is not met in the increase from 9% to 21% VAT.

When setting a rate according to external effect, it is desirable to take into account the minimum desirable price increase during the gradual increase.

Legal practicability

Good. Each EU Member State has the option of introducing a special consumption tax, provided that the conditions are met (no sales tax character; no border formalities).

Tax practicability

A new tax (other than VAT) requires a new declaration system, which must be linked to the other automated systems (such as collection systems). New taxes cannot be included in the collection system until 2023.

Administrative feasibility

Increasing VAT may create taxation problems for taxpayers between meat and meat-containing products. An alternative could be to increase the VAT on all products that are meat or contain meat. This can give an extra impulse to the switch from animal to vegetable products.

Raising a rate based on external effect per kilo can be done in two ways: with butchers/slaugherhouses and with supermarkets/retail. For products in which meat has been processed, the rate is determined in proportion to the quantity of processed meat. Levies on these parties are subject to a large number of taxpayers (CE Delft: 8,420). To avoid this, the tariff can be placed earlier in the chain, for example with slaughterers and importers. In that case, the number of taxpayers is smaller (CE Delft: I1.795). However, the tax does require import / export corrections to prevent exports from being taxed and imports of meat not. This requires complex administration at the slaughterhouses / importers.

Impact and support

By combining a price increase on meat with a tax reduction elsewhere (for example via the Income Tax) or with a price reduction on fruit and vegetables (for which there is support), the support for a price increase for meat can be increased.

Administrative burdens for citizens and companies

No burdens for livestock farmers; depending on form limited burden at butcher / supermarket or slaughterer / importer. Government burden for setting up monitoring.

Measure in a broader perspective

Reducing meat consumption can lead to a reduction in environmental pressure. It is then important to find out how meat is replaced in the consumption pattern. This replacement of meat in the consumption pattern will negate part of the calculated environmental gains. The extent to which this happens depends on the choices made by the consumer.

It is therefore important to have a price increase for meat accompanied by additional policies to promote healthy and sustainable food choices, such as a price reduction for healthy and sustainable products.

In the case of a VAT increase for meat, it must be taken into account that this increase has a greater effect on organically or otherwise more sustainably produced meat. After all, the cost price of such products is higher than for meat from conventional intensive production. This effect can be counterproductive to the ambition to stimulate more sustainable choices. Pricing the external effect can meet this disadvantage, provided that the determination of the external effect can take place sufficiently accurately at company level.

In that case, the price surcharge shows which products have a lower environmental impact. This becomes all the more clear when the price mark-up for the external effect is separately visible to the consumer. The proposed pricing of the external effect is based on the environmental impact of the production method. Other aspects of sustainability such as animal welfare and fair trade (think of soy for animal feed) are not reflected in this. As a result, the consumer may be faced with a choice to weigh animal welfare against environmental pressure. A single, unambiguous sustainability characteristic in which all aspects are taken into account and weighed up can meet this. It may also be useful to see whether meat can be included in a meat tax as an ingredient in food products. Now we only looked at finished meat products.

The proposed tax systems do not yet differentiate for the country of origin. This means that a cheaper piece of meat from abroad can, despite the tax, remain cheaper and therefore more attractive to the consumer. By the combination of information about sustainability and possible standardization (see sheet 8), this effect can be controlled.

A further form of price differentiation could also be envisaged, whereby the tax base of the tariff is based on the environmental pressure of the meat production at the livestock farmer / poultry farmer / pig farmer. This means that for meat from livestock farmers that cause little external costs, a lower rate per kg of meat is paid than if it comes from livestock farmers that cause high external costs. This requires clear agreements about emission registration and, for example, an opt-in for foreign livestock farmers to participate in the registration.

This system has the advantage, for example, that meat produced in the Netherlands by organic farmers is taxed less than meat from non-organic farmers. It is therefore even better to differentiate for meat produced less sustainably from abroad.

Attachment 2. Making fruit and vegetables cheaper (translation of BRS text)

Promotion of health related to consumption

The Health Council makes a link between the consumption of fruit and vegetables and a reduced risk of certain diseases. Specifically, eating fruits and vegetables has been shown to lower the risk of coronary heart disease and stroke. Furthermore, there is a link between the consumption of vegetables and a lower risk of colon cancer and between green leafy vegetables and a lower risk of diabetes and lung cancer. Fruit consumption is associated with a lower risk of diabetes, colon cancer and lung cancer. In its 'Guidelines for Good Nutrition 2015', the Health Council of the Netherlands recommends eating according to a more plant-based and less animal-like diet and eating more fruit and vegetables than the Dutch do now.

The measure sends a signal via the lower price regarding the desirability of eating more fruit and vegetables. Due to the lower price, consumption increases slightly, as does production.

Elaboration of the instrument

If possible, consideration could be given to providing a subsidy ("negative consumption tax") that can be justified on the basis of the positive effect on health. The manner in which this is provided must then be further elaborated.

Consideration could also be given to designing the measure via the VAT rate. Price differentiation or, for example, a lower rate of 5% on fruit and vegetables produced in the Netherlands and abroad.

Indication of effect on indicators

(impact on climate, environment and health)

The figures presented here are based on simplified model calculations, for the method, its limitations and the sources and assumptions used, see appendices 8 and 9. These figures indicate the magnitude of the effect. The assumptions made can have a major effect on the results of the calculations. The figures can therefore only be used to compare the magnitude of the effects of the various price interventions in this report.

A reduced price for fruit and vegetables will result in the Dutch population consuming more of these products. Health gains can be made with a higher consumption of fruit and vegetables. The number of new patients will decrease for a number of diseases. The number of new patients (incidence) decreases by 0-1%, as a result of which the costs for these diseases decrease and the perceived burden of disease also decreases (1382 DALYs). On the other hand, greater demand for fruit and vegetables will lead to greater production. On a global scale, environmental pressure will therefore increase as a result of increased consumption in the Netherlands. However, if, at the same time, for the benefit of a "protein transition" there is an increase in the meat load and thus a decrease in meat consumption, environmental gains can still be expected.

The increase in environmental pressure from increased consumption of fruit and vegetables is based on the current mix of products we consume within this category. By choosing other products within this category, the increase in environmental pressure can be limited.

A small decrease in the number of new cases of disease for a number of diseases leads to a reduction in healthcare costs for those diseases. In addition, (some of) these people will develop other diseases. Someone who does not develop colon cancer may develop Alzheimer's later in life.

The main benefit of the measure is therefore the increase in perceived health, expressed in a decrease in the number of years of life with illness or earlier death. These so-called DALYs can be expressed in euros.

To explain: the consumer surplus represents the (total) valuation that the consumer has for a product, minus what he / she actually has to pay for the product. The tables always show the change in consumer surplus relative to the baseline situation. This therefore concerns the change in the consumer surplus, as a result of the target tax or VAT adjustment. As a rough first order approach, it can be said that the change in the consumer surplus is roughly equal to the amount that the consumer buys in the new situation (after the tax change) multiplied by the price decrease / price increase. Thus, the change in consumer surplus is roughly the change in consumer spending due to the tax. The consumer surplus is a measure of the welfare effect (if the tax becomes lower, the consumer will benefit in prosperity, he / she has to pay more for the taxed product).

The producer surplus is the difference between revenues (from the sale of consumer products by the retailer) minus the variable costs. The amount can be seen as a reward for the fixed / primary production factors. In the tables, the focus is always on the change in the producer surplus, relative to the initial situation. It can be understood as a change in the "profit" for the retailers.

Assessment criteria

Effectiveness

The measure is effective in influencing consumer behavior in the desired sense. However, the expected consumption effects and thus prosperity gains seem small as a result of a VAT reduction to 5%.

Nor is it clear when VAT is reduced whether the price reduction is passed on to consumers.

Legal practicability

Good. Several member states in Europe have a lower rate than the rate in the Netherlands. Europe has a minimum of 5%.

Technical feasibility

Fruits and vegetables are often incorporated into or supplied with other products or catering rights. This presents a demarcation and implementation problem for supplying entrepreneurs and the tax authorities.

If consideration is given to designing the price reduction as a "subsidy", this has the advantage that, unlike with a reduced VAT rate, the costs are easier to control.

In a European context, more space is being considered for VAT differentiation. A number of countries already apply a separate rate for fruit and vegetables. In the current sales tax return system in the Netherlands, the implementation of a third rate in addition to the 9% and 21% rate is not applicable in the short term. This means that implementation of this form of price reduction will not be reasonable within the next cabinet period.

Administrative burdens for citizens and businesses

If a reduced VAT rate is applied, ensuring correct application in all trade links will increase the administrative burden.

Support base

Since the increase in VAT on fruit and vegetables on 1/1/2019, various organizations have made repeated calls to return to a lower rate due to the expected health benefits.

A Multiscope survey of 1,000 consumers shows that 80% believe that VAT should be reduced to encourage people to eat healthier.

Measure in a broader perspective

A price intervention is especially effective when it is used in combination with other price measures. This discourages unhealthy and more environmentally harmful dietary patterns and promotes healthier less environmentally harmful dietary patterns.

The increase in environmental pressure due to greater consumption of fruit and vegetables can be mitigated by promoting the consumption of regionally produced seasonal fruit and vegetables over products with a greater environmental impact in flanking policies (eg in transparency of sustainability characteristics). In addition, a simultaneous increase in the price of meat can lead to an increase in fruit and vegetable consumption even further than estimated here.

Budgetary effects

Make fruit and vegetables cheaper (price drop analogous to VAT reduction to 5%): 160 million euro per year, starting from 2023.

[1] DALY: change in experienced time of sickness (verandering in ervaring ziektelast)

[2] DALY: change in experienced time of sickness (verandering in ervaring ziektelast)

[3] DALY: change in experienced time of sickness (verandering in ervaring ziektelast)